Different ways of using Gunbot

Swiss army knife of bots

Accumulation bot

Manual accumulation slowing you down? With Gunbot, 'buying the dip' becomes effortless. Configure the bot to accumulate assets by disabling the sell part of your strategy. Set your timeframe and balance limits, and watch Gunbot work its magic - every time the market dips.

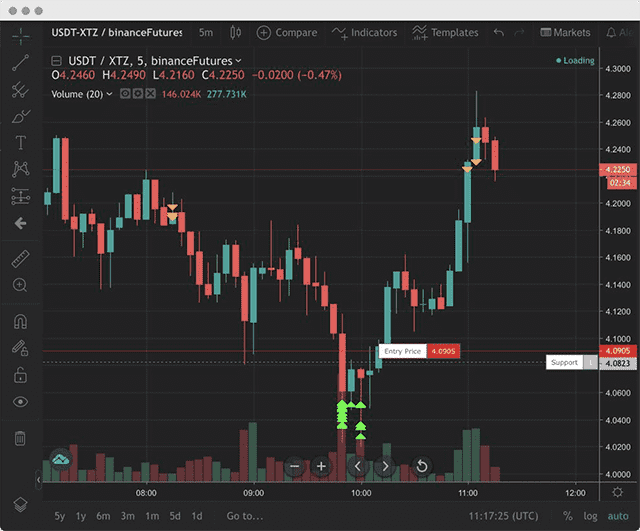

Manual Buying, Automated Selling

Are you a hands-on trader? Speed up your manual buying process with Gunbot. Buy assets manually and let the bot handle optimal exits for your trades. Utilize powerful sell methods like "tssl" for price-based actions and grid methods for scaling out across multiple trades. Gunbot seamlessly integrates with manual trading, ensuring a smooth experience.

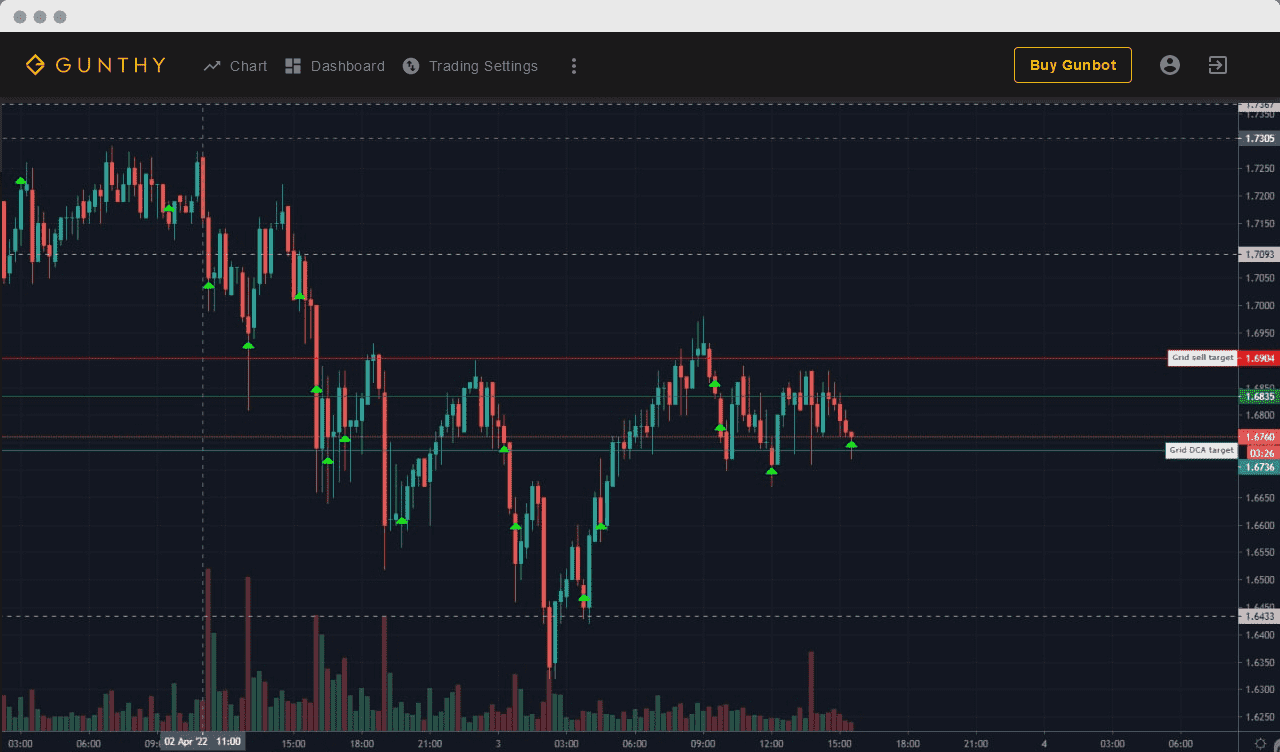

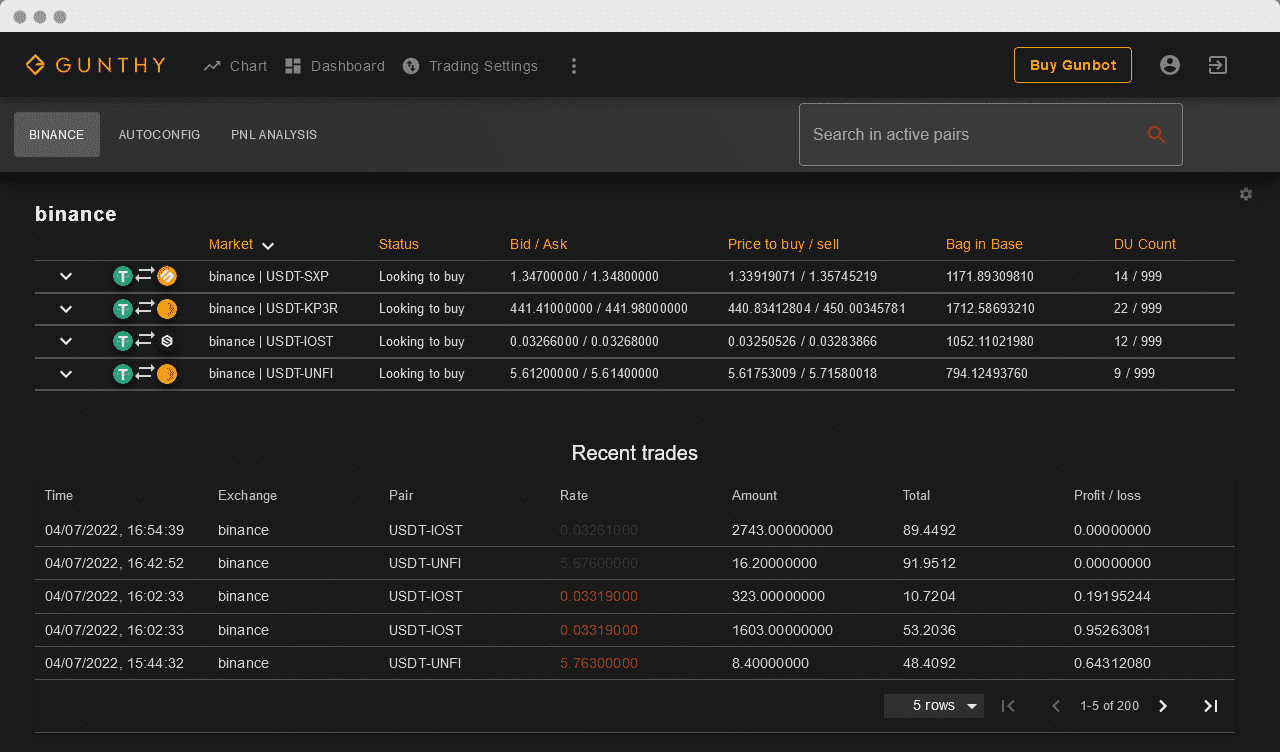

24/7 Fully Automated Trading

Seize every market movement, day or night. Gunbot offers fully automated trading that never sleeps. Its robust grid strategies simplify trading, while automated balance management and asset selection enhance efficiency. With Gunbot, you can navigate changing market conditions with ease, thanks to dedicated risk management features.

Get Rid of Losses with Gunbot

Made a bad investment and forgot to set a stop limit? It happens to the best of us, but Gunbot is here to assist

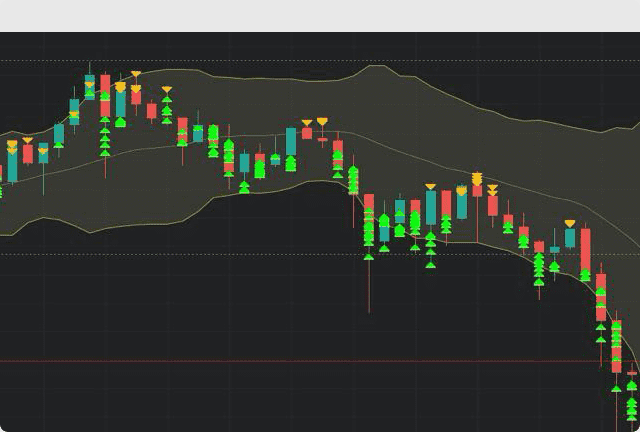

Utilize Gunbot's powerful Dollar-Cost Averaging (DCA) capabilities to manage your trading losses. Aggressively average down the price per unit, sell at a profit, and stop trading the asset.

Alternatively, employ Reversal Trading to accumulate in downtrending markets. This strategy involves repeatedly selling assets and buying more units at lower rates, all while working with the initial capital.

Read more about Reversal Trading

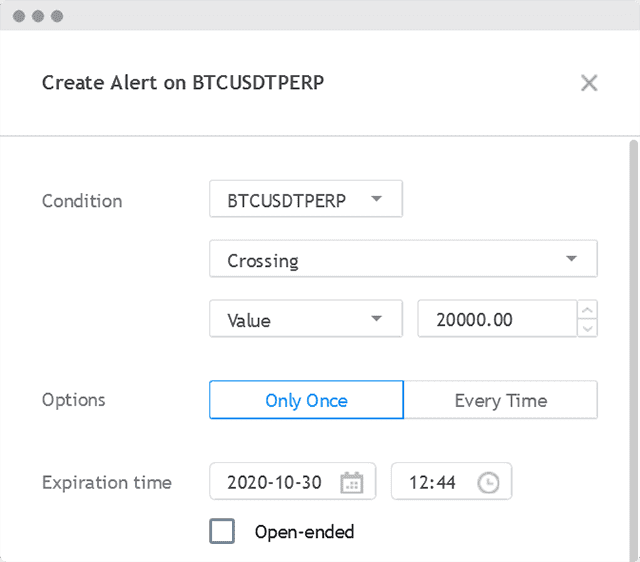

Seamlessly Integrate TradingView Alerts

Take your trading to the next level by integrating Gunbot with TradingView alerts. With the TradingView add-on, Gunbot listens to email alerts from tradingview.com and executes orders instantly on your exchange. Whether you have custom strategies coded in Pine Script or want to blend Gunbot strategies with TradingView alerts, the possibilities are endless.

Boost Liquidity for Your Crypto Project

If you're a stakeholder in a crypto project, Gunbot can help you enhance liquidity. Utilize a simple staggered order strategy to provide liquidity for spot trading on both the taker and maker sides.

Gunbot offers flexibility - choose between purely providing liquidity or aiming to break even. Empower your project with increased liquidity and seamless trading experiences.