I’m a rocky in this world and very surprise that I’m on the leaderboard must I say. I tried other platforms but Gunbot is the best because there is a very helpful community and developers. I tried some strats and at the end I’m very happy with MFrider for a mid / longterm.

Gunbot. Community made crypto trading bot

Privacy-first crypto trading bot for 20+ supported exchanges. Runs locally on Windows, Linux and macOS. API secrets stay on your own device.

Deploy pre-tuned strategies immediately, or build your own custom automation.

One time license. No subscription fees.

Find Your Edge with Gunbot's Automated Trading Strategies

From reliable pre-configured bots to a high-performance engine for your custom logic, discover how Gunbot helps you trade smarter.

Deploy Proven Strategies Out of the Box

Reliable Automation, Your Private Edge

Gunbot runs on your local machine, ensuring your strategies and API secrets remain completely private. Its robust core manages orders with low latency, providing a stable platform to execute a diverse range of proven trading concepts on any supported spot or futures exchange.

Key Features

- Volatility Capture (Grid Bots)Automatically buy low and sell high within market ranges using strategies like 'gridbot' or 'stepgrid'.

- Dollar Cost Averaging (DCA)Methodically lower your average entry price on high - conviction assets using 'spotgrid' logic.

- NoCode Builder - Combine indicators like RSI, MACD, and Bollinger Bands to create complex rules without writing a single line of code.

- Dynamic Price TrailingSecure better entries and lock in more profit with intelligent, event - driven trailing stops.

- Risk ManagementDefine exactly how much capital to risk per trade and per pair, protecting your portfolio from overexposure.

- FeeAware Logic - All profit targets automatically account for exchange fees, ensuring your realized gains are net positive.

Automate your trading with battle-tested strategies that execute with discipline, 24/7. Systematically capture profits from market volatility without letting emotion dictate your decisions.

Community

What traders are saying

I tested a few automated trading bot software last few weeks, and Gunbot stands out as the best one because it's not limited like the others. Well done, guys!

Would definitely give Gunbot 5 stars. Because even for someone like me, who is a complete beginner to the world of trading bots, and will obviously struggle with the typical 'newbie' error codes associated with setting up a new software that you are not familiar with. Their fast responding support team and wiki were more than enough to solve theseissues.

Trailing stops are great and all but let’s be honest, on markets that run 24/7 more is required. Much more. GunBot was something I wished for a long time and my only regret is not doing it sooner. The bot itself has been awesome so far, and the support has been even better. Very fast responses, super knowledgeable, and friendly.

It’s extremely intimidating to allow a bot to control large sums of your money. Support had me go live in two days from payment to first trade. I’m sitting here writing this, watching my daughter play, bot streaming in background, and I finally feel like I can look away from my screen for more than 10 minutes.

Outstanding Trading Bot with Robust Features and Reliability! Gunbot has consistently exceeded my expectations.

Its making money out of the box just after editing balance settings, I have a plan to use it for scalping using TA, turning it on or off depending on the market, but so far it is great.

StepGrid has become default to beat (and pretty hard)

I want to thank you for guiding me and being a motivator and a jumpstater for my GUnbot dev path 25 days ago. It was successfull so far. I want to share some of my success in comparison with bybits TOP Copy Traders and glimpse of My Gunbot custom Future COPYtrading software beating the best in the COPYTrading world.

BTW, your support is mind-blowing, but watching your baby bot grow for a few years now is a whole other game. You guys are absolutely the best!

The strats in the last year have been just crazy. The competition and especially the top 5 each time are just completely insane. The last year for Gunbot was unbelievable. If we had what we have right now, with no changes or updates, we would be already golden. Those strats just keep getting better and more refined. I never felt more confident in recommending Gunbot to a friend than now.

Great peace of Software. Always evolving. New features added all the time without additional cost. Amazing community helping each other out with trading and other stuff.

I look around and see so many talented people working on their own great strategies. It's very heartening to be with people who want the same.

I knew manual trading pretty good but GB was the catalyst to learn how to codify that.

Best Software of its kind. I have been using Gunbot for almost a year now; its performance is remarkable and automation makes it a real money maker with added peace of mind. The team is very supportive and the documentation is excellent. Still more valuable features can be added that I am looking forward to see.

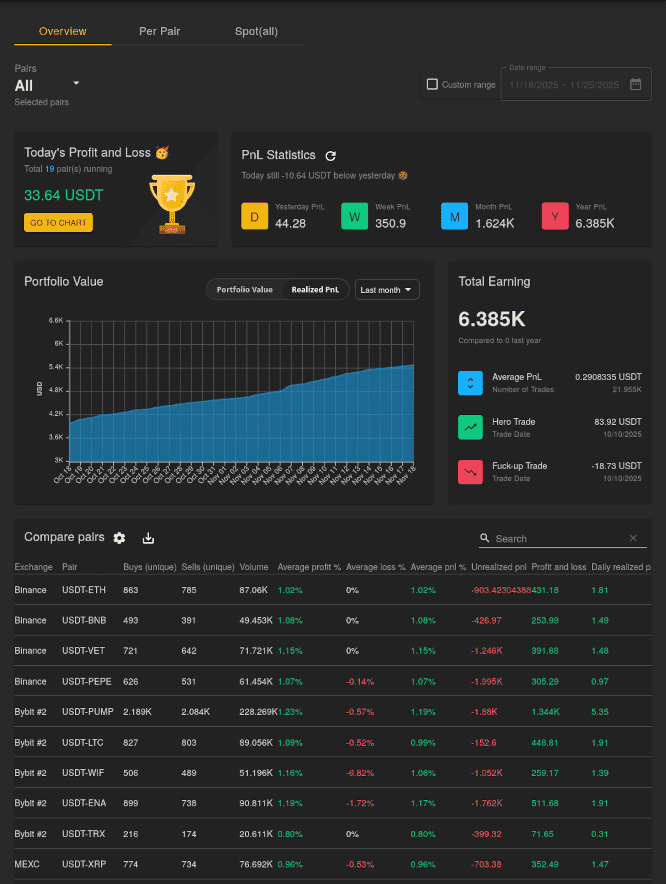

I’m a rocky in this world and very surprise that I’m on the leaderboard must I say. I tried other platforms but Gunbot is the best because there is a very helpful community and developers. I tried some strats and at the end I’m very happy with MFrider for a mid / longterm.

I tested a few automated trading bot software last few weeks, and Gunbot stands out as the best one because it's not limited like the others. Well done, guys!

Would definitely give Gunbot 5 stars. Because even for someone like me, who is a complete beginner to the world of trading bots, and will obviously struggle with the typical 'newbie' error codes associated with setting up a new software that you are not familiar with. Their fast responding support team and wiki were more than enough to solve theseissues.

Trailing stops are great and all but let’s be honest, on markets that run 24/7 more is required. Much more. GunBot was something I wished for a long time and my only regret is not doing it sooner. The bot itself has been awesome so far, and the support has been even better. Very fast responses, super knowledgeable, and friendly.

It’s extremely intimidating to allow a bot to control large sums of your money. Support had me go live in two days from payment to first trade. I’m sitting here writing this, watching my daughter play, bot streaming in background, and I finally feel like I can look away from my screen for more than 10 minutes.

Outstanding Trading Bot with Robust Features and Reliability! Gunbot has consistently exceeded my expectations.

Its making money out of the box just after editing balance settings, I have a plan to use it for scalping using TA, turning it on or off depending on the market, but so far it is great.

StepGrid has become default to beat (and pretty hard)

I want to thank you for guiding me and being a motivator and a jumpstater for my GUnbot dev path 25 days ago. It was successfull so far. I want to share some of my success in comparison with bybits TOP Copy Traders and glimpse of My Gunbot custom Future COPYtrading software beating the best in the COPYTrading world.

BTW, your support is mind-blowing, but watching your baby bot grow for a few years now is a whole other game. You guys are absolutely the best!

The strats in the last year have been just crazy. The competition and especially the top 5 each time are just completely insane. The last year for Gunbot was unbelievable. If we had what we have right now, with no changes or updates, we would be already golden. Those strats just keep getting better and more refined. I never felt more confident in recommending Gunbot to a friend than now.

Great peace of Software. Always evolving. New features added all the time without additional cost. Amazing community helping each other out with trading and other stuff.

I look around and see so many talented people working on their own great strategies. It's very heartening to be with people who want the same.

I knew manual trading pretty good but GB was the catalyst to learn how to codify that.

Best Software of its kind. I have been using Gunbot for almost a year now; its performance is remarkable and automation makes it a real money maker with added peace of mind. The team is very supportive and the documentation is excellent. Still more valuable features can be added that I am looking forward to see.

Bought Gunbot in November, fumbled with Sim in December... Kicked off real trading last month... And after 1 month I made back the ultimate lifetime licence cost 2 times. Thanks for your great software @GuntharDeNiro and to all those who helped make it stronger with new strategies and feedback for improving the systems over the years. This is the best bot I have seen in terms of control we have as a user.

I did a substantial amount of research before purchasing automated trading software and I can confidently say I have zero regrets going with Gunbot. I come from a manual trading background, and the support network here is absolutely insane in terms of helpfulness—the response time is faster than what you would get from your wife! This product deserves a 5 star review ALL DAY LONG.

Look, use stepgridscalp leave default and make money. [...] This community is fantastic and I will testify it is not a scam. Been a part of it since 2017. Making big fucking money with it.

Major love to the GB team. I started trading on DYDX using SGSFutures on Feb 26th. Started with $496 USD and I'm currently at $1,358 USD today in portfolio value. Running on 20 pairs. :)

I bought Gunbot back in the end of 2017, traded a bit, but then other things came in the way so I put it on ice. Recently I wrote a message in the contact form, and after like 20 minutes I got an email. They helped me get the bot back up running almost instantly. I did not expect such customer service after 3 years of owning a crypto bot. Gunbot withstands the test of time!

Running so good out of the box I haven’t really looked into all switches and details

StepGridHedge worked like a charm in this up/down market, so far best from out of the box strategy, fire and forget and drink mojitos :)

After being quite suspicious I have quite good results with the spotgrid. Did not understand it properly in the first place - but now got the hang of it and it works quite well.

It's a great product. I spent about a year working on my own bot in Python before discovering Gunbot. It turned out to be exactly what I envisioned for my 'dream bot,' but far more advanced and mature. That's why I consider it an excellent product that is worth every dollar. Thank you very much, and Merry Christmas!

Having purchased Gunbot back in 2017, and using it on and off throughout the years, I am always impressed by the improvements made here internally and through the community. I rarely have to ask questions because I can find what I need on the wiki or through the telegram channel. You guys are amazing and thank you.

I’ve been using Gunbot for quite some time, and it has been a solid trading tool for me. The interface is easy enough to pick up, but it’s definitely not for complete beginners with no trading experience. You still need to think things through and apply your own knowledge to get the best results from its many features. In terms of performance, it has been consistent, and I’ve rarely run into issues. When I did have questions, the support team responded quickly and helped me out. If you know your way around trading and want a bot that offers flexibility, Gunbot is a good choice.

My friend and I have been comparing Eazybot vs Gunbot. Gunbot is definitely better and more flexible in the long run. In addition, so far it is winning the comparisons we've been doing.

I am very thankful for everyone here—a fun little community! The difference since 5 years ago would be difficult to even explain to new users. There are some extremely talented/ingenious people here.

I remember the time I came to Gunbot from Haasonline; I have made maybe the rightest choice in my life.

Bought Gunbot in November, fumbled with Sim in December... Kicked off real trading last month... And after 1 month I made back the ultimate lifetime licence cost 2 times. Thanks for your great software @GuntharDeNiro and to all those who helped make it stronger with new strategies and feedback for improving the systems over the years. This is the best bot I have seen in terms of control we have as a user.

I did a substantial amount of research before purchasing automated trading software and I can confidently say I have zero regrets going with Gunbot. I come from a manual trading background, and the support network here is absolutely insane in terms of helpfulness—the response time is faster than what you would get from your wife! This product deserves a 5 star review ALL DAY LONG.

Look, use stepgridscalp leave default and make money. [...] This community is fantastic and I will testify it is not a scam. Been a part of it since 2017. Making big fucking money with it.

Major love to the GB team. I started trading on DYDX using SGSFutures on Feb 26th. Started with $496 USD and I'm currently at $1,358 USD today in portfolio value. Running on 20 pairs. :)

I bought Gunbot back in the end of 2017, traded a bit, but then other things came in the way so I put it on ice. Recently I wrote a message in the contact form, and after like 20 minutes I got an email. They helped me get the bot back up running almost instantly. I did not expect such customer service after 3 years of owning a crypto bot. Gunbot withstands the test of time!

Running so good out of the box I haven’t really looked into all switches and details

StepGridHedge worked like a charm in this up/down market, so far best from out of the box strategy, fire and forget and drink mojitos :)

After being quite suspicious I have quite good results with the spotgrid. Did not understand it properly in the first place - but now got the hang of it and it works quite well.

It's a great product. I spent about a year working on my own bot in Python before discovering Gunbot. It turned out to be exactly what I envisioned for my 'dream bot,' but far more advanced and mature. That's why I consider it an excellent product that is worth every dollar. Thank you very much, and Merry Christmas!

Having purchased Gunbot back in 2017, and using it on and off throughout the years, I am always impressed by the improvements made here internally and through the community. I rarely have to ask questions because I can find what I need on the wiki or through the telegram channel. You guys are amazing and thank you.

I’ve been using Gunbot for quite some time, and it has been a solid trading tool for me. The interface is easy enough to pick up, but it’s definitely not for complete beginners with no trading experience. You still need to think things through and apply your own knowledge to get the best results from its many features. In terms of performance, it has been consistent, and I’ve rarely run into issues. When I did have questions, the support team responded quickly and helped me out. If you know your way around trading and want a bot that offers flexibility, Gunbot is a good choice.

My friend and I have been comparing Eazybot vs Gunbot. Gunbot is definitely better and more flexible in the long run. In addition, so far it is winning the comparisons we've been doing.

I am very thankful for everyone here—a fun little community! The difference since 5 years ago would be difficult to even explain to new users. There are some extremely talented/ingenious people here.

I remember the time I came to Gunbot from Haasonline; I have made maybe the rightest choice in my life.

Choose your trading bot

Select the license that fits your trading style. Pay once, trade forever.

Gunbot Standard

Everything you need to get started with bot trading on one exchange

- ✓Spot and futures tradingOptimized for spot and futures markets.

- ✓Works with 1 exchangeIncludes 1 API slot for any supported exchange.

- ✓Unlimited trading pairsNo limit on the number of pairs you can trade simultaneously.

- ✓Unlimited gridbotsRun as many gridbots as you want with no cap.

- ✓Pre-built strategies includedAll native Gunbot strategies are included and fully customizable.

- ✓Switch exchanges anytimeChange to another exchange or API key anytime, for free.

- ✓AutoConfigAutomate config changes like adding pairs or adjusting strategy parameters.

- ✓500 Gunthy tokensYour license includes 500 Gunthy tokens for the blockchain-based license system.

- ✓Email support & community chatGet help via email and the active Gunbot Telegram community.

- ✓Lifetime license, no monthly costsOne-time purchase with no recurring fees.

- ✓For Windows, Mac, LinuxGunbot runs locally on Windows, Mac, and Linux.

Gunbot Pro

For trading on multiple exchanges, includes backtesting and 3 exchange slots

- ✓Everything in StandardIncludes all Standard features plus more.

- ✓Works with 3 exchangesIncludes 3 API slots to trade on up to three exchanges at once.

- ✓Backtesting toolsTest and optimize your strategies in detail before deploying live.

- ✓750 Gunthy tokensIncludes 750 Gunthy tokens for your blockchain license.

- ✓Lifetime license, no monthly costsOne-time purchase with no recurring fees.

- ✓For Windows, Mac, LinuxGunbot runs locally on Windows, Mac, and Linux.

Gunbot DeFi

Full access: DeFi, unlimited exchanges, custom strategies, API, webhooks

- ✓Everything in ProIncludes all Pro features plus advanced DeFi and automation tools.

- ✓DeFi tradingSupports decentralized platforms like PancakeSwap, HyperLiquid, and dYdX.

- ✓Unlimited exchangesTrade on all supported exchanges, one API slot per exchange.

- ✓Custom JavaScript strategiesCreate strategies using plain JavaScript with full API access.

- ✓Mobile app accessMonitor all your bots through the Gunbot X mobile app.

- ✓Trading simulatorForward-test any strategy on real market data without risking funds.

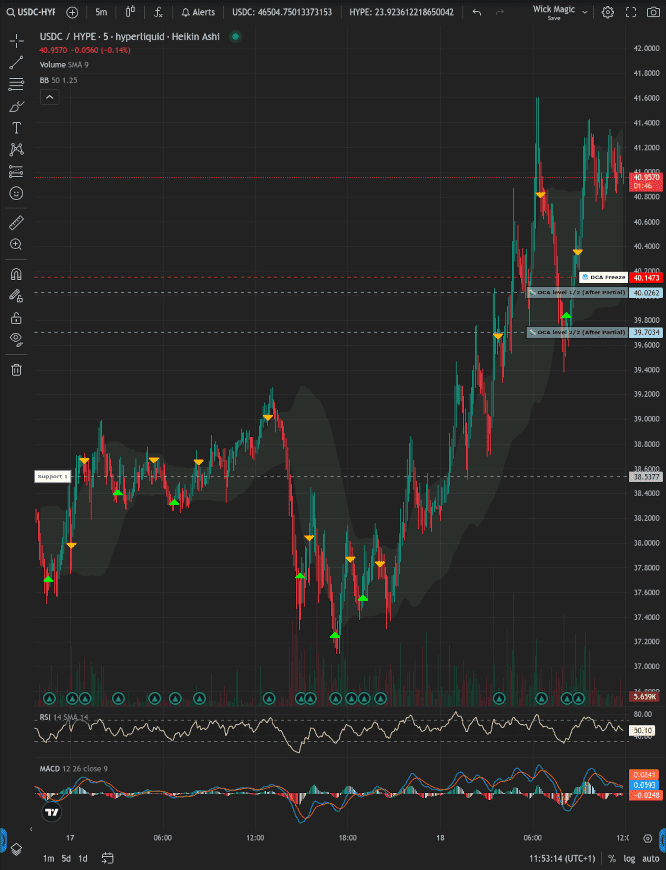

- ✓TradingView integrationExecute trades directly from TradingView alerts via email or webhook.

- ✓REST API accessIntegrate Gunbot with external tools or build your own interface.

- ✓2,500 Gunthy tokensIncludes 2,500 Gunthy tokens for the blockchain-based license system.

- ✓Lifetime license, no monthly costsOne-time purchase with no recurring fees.

- ✓For Windows, Mac, LinuxRuns locally on all major desktop systems.

Next-generation automation

The most flexible bot for crypto

Enhance your trading capability with Gunbot - a versatile platform for algorithmic trading. Use proven presets or craft your own algorithms in our feature overview.

Total Control: Your Bot, Your Privacy

Unlike cloud-based alternatives, Gunbot runs locally on your hardware. You maintain absolute control and privacy on Windows, macOS, or Linux while connecting to supported exchanges.

Ready-to-Deploy Strategies

Activate pre-tuned algorithms like stepgridscalp in moments. Supports Spot markets and leveraged Futures/Derivatives.

Unlimited Customization

Built for power users. Run unlimited instances, create custom strategies, and automate config changes via API.

Lifetime License, Free Updates

Gunbot includes free updates for all license types. Pay once and receive continuous enhancements without monthly subscriptions. When you are ready to deploy, download the latest Gunbot build.

Why Traders Prefer Gunbot

Imagine bot crypto trading without constraints - Gunbot empowers you to seize profit opportunities around the clock. If you are new, start with how Gunbot works. If you want to trade on-chain, explore DeFi trading automation.

Privacy-Focused Trading

Gunbot values your privacy. Unlike typical bot trading platforms, Gunbot never tracks your trading data. The only exception to this is our voluntary leaderboard, which needs minimal data collection only used for the leaderboard.

Combine Manual and Bot Trading

Seamlessly merge manual and automated trading. Manually bag-fill a position or take partial profits; Gunbot automatically recalculates the break-even and exit points for the remaining execution. See use cases.

Dedicated Support

Receive quick, helpful human support, detailed documentation, and community insights anytime.

Multi-timeframe spot and futures bots

Advanced Grid and DCA Systems

Gunbot's smart grid strategies redefine the standard. Unlike basic grid bots, Gunbot offers dynamic controls:

Limit Grids: Efficient maker orders with custom grid sizing and auto-rebalancing.

Trend Detection: Automatically halts buying during adverse trends to protect capital.

Dynamic Targeting: Grid lines adjust automatically based on recent volatility (ATR).

Price Trailing: Improve fill rates significantly using advanced trailing, even within grid strategies.

Gunbot supports every trading style, covering the full spectrum of Accumulation, DCA, and Scalping. For platform comparisons, read the trading bot guide. For live user outcomes, review the leaderboard and futures leaderboard.

Take control of your trading infrastructure.

How Gunbot works// AstroWave v1 - Volatility & Momentum Hybrid

const c = gb.data.candlesClose, h = gb.data.candlesHigh, l = gb.data.candlesLow, bid = gb.data.bid;

const atr = (gb.method.tulind.indicators.atr.indicator([h, l, c],[14]))[0].pop();

const mom = (gb.method.tulind.indicators.mom.indicator([c],[10]))[0].pop();

const vol = (atr / bid * 100).toFixed(2);

const gotBag = gb.data.gotBag, bal = gb.data.baseBalance;

gb.data.pairLedger.sidebarExtras = [

{label:'Volatility',value:vol+'%'},

{label:'Momentum',value:mom.toFixed(2)},

{label:'Signal',value: mom>0?'Bullish':'Bearish'}

];

gb.data.pairLedger.customBuyTarget = bid * 0.995;

gb.data.pairLedger.customStopTarget = bid * 0.98;

if (!gotBag && mom>0 && vol>0.5) {

gb.method.buyMarket((bal/bid)*0.6, gb.data.pairName);

gb.data.pairLedger.notifications=[{text:'⚡ AstroWave BUY',variant:'success'}];

}

if (gotBag && (mom<0 || vol>5)) {

gb.method.sellMarket(gb.data.quoteBalance, gb.data.pairName);

gb.data.pairLedger.notifications=[{text:'💨 AstroWave EXIT',variant:'danger'}];

}From concept to code instantly

Build your own AI trading bot

Transform your trading concepts into executable strategy prototypes in seconds. Gunbot AI allows you to generate trading bots using simple text descriptions. Powered by the same technology as ChatGPT, Gunbot AI understands specific Gunbot methods and data points, empowering both experienced quants and automation enthusiasts to rapidly create custom logic. Always test machine-generated strategies in the simulator before real trading to ensure reliability. Experience the future of algorithmic trading development. Examples have not been edited.

Core Features & Capabilities

Advanced Trading Strategies

Access 20+ battle-tested strategies like StepGrid and SpotGrid. Fine-tune them with over 150 configurable parameters.

Trade Unlimited Pairs

Trade without restrictions. Launch your bot on one or hundreds of markets simultaneously.

Optimized Trailing

Maximize margins with customizable trailing. Entries and exits trigger only when price action confirms the move.

Technical Indicators

Native support for ADX, RSI, Stochastic, StochRSI, MFI, EMA, and EMAspread to refine your market timing.

Dynamic AutoConfig

The bot that adapts. Automatically switch strategies or risk limits based on real-time market volatility.

Visual Trading Targets

Visualize your strategy logic. View targets and indicators overlayed directly on integrated TradingView charts.