Tenkan Futures Trading Strategy

An easy to use strategy with built in DCA and ROE trailing, using the Ichimoku tenkan line.

This strategy uses a limited subset of the regularly available strategy settings.

Only the strategy options shown in the strategy editor for Tenkan have an effect.

Trading behavior

A long position is opened when price is below kumo and tenkan crosses down the candle body.

If the same happens again at a price at least 'DCA spread' below the previous order, a DCA order is placed.

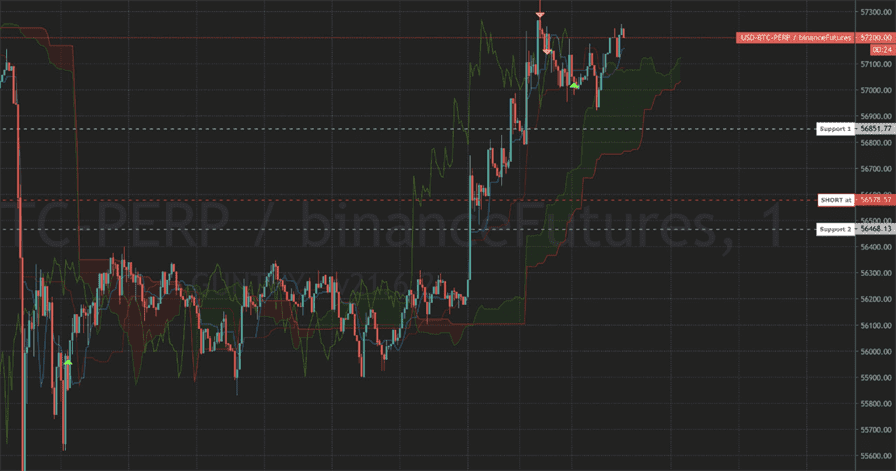

A short position is opened when price is above kumo and tenkan crosses up the candle body.

If the same happens again at a price at least 'DCA spread' above the previous order, a DCA order is placed.

To close a trade, the opposite conditions of opening it must happen and ROE scalper must finish trailing.

Tenkan settings

Basic Settings

| Label | Config Parameter | Default Value | Detailed Description |

|---|---|---|---|

| Trading limit | TRADING_LIMIT | 20 | The base amount you will invest for each individual buy order. |

| Max open contracts | MAX_OPEN_CONTRACTS | 0 | Sets the maximum size of a futures position, expressed in quote units (e.g., BTC in a USDT-BTC pair). If executing a subsequent order would exceed this limit, the order will not be placed. If the position size exceeds this limit, a reduction of the position will be enforced to comply with the set maximum. |

Customize targets

| Label | Config Parameter | Default Value | Detailed Description |

|---|---|---|---|

| ROE | ROE | 1 | Targets a Return on Equity (ROE) to close positions. The ROE is calculated based on the leverage used. |

| ROE limit | ROE_LIMIT | 1 | Defines a trailing range for ROE trailing as a percentage of the actual ROE. |

| DCA spread | DCA_SPREAD | 2 | Specifies the minimum percentage distance between the last order rate and the placement of Dollar Cost Averaging (DCA) orders. |

Indicators

| Label | Config Parameter | Default Value | Detailed Description |

|---|---|---|---|

| Period | PERIOD | 15 | Chooses the candle period used for calculating auto step size and trailing range. Lower values lead to higher trading frequency and associated risk. |

| Tenkan period | TENKAN_PERIOD | 9 | Defines the number of candles to use for the calculation of the Tenkan-sen indicator. |

| Kijun period | KIJUN_PERIOD | 26 | Specifies the number of candles used to calculate the Kijun-sen indicator. |

| Senkouspan period | SENKOUSPAN_PERIOD | 52 | Determines the number of candles used for calculating the Senkou-span. |

| Displacement | DISPLACEMENT | 26 | Indicates the number of candles to displace the Chikou-span and Kumo in the Ichimoku Kinko Hyo indicator. |

| Candles length | CANDLES_LENGTH | 400 | Specifies the number of candles requested from the exchange. Ensure this value is at least equal to the highest period setting among your indicators to maintain data consistency. |

Advanced

| Label | Config Parameter | Default Value | Detailed Description |

|---|---|---|---|

| Market buy | MARKET_BUY | True | Places buy orders as market orders. When disabled, buy orders are placed as limit orders. |

| Market sell | MARKET_SELL | True | Places sell orders as market orders. When disabled, sell orders are placed as limit orders. |

| Market close | MARKET_CLOSE | False | Places close orders as market orders. When disabled, close orders are sent as limit orders. |

| Maker fees | MAKER_FEES | False | Enables the use of Post Only orders on Bitmex. It is usually paired with a negative pre-order gap setting to take advantage of reduced fees for maker orders. |

| ROE spread | ROE_SPREAD | 0 | Allows for the placement of an additional order worth the trading limit when ROE reaches the target and continues increasing by the specified ROE spread. A setting of 0 disables this feature. |