Built-In Strategies

The most common way to use Gunbot is by using its built-in strategies. In this article, we'll explore the options you have with built-in trading strategies.

A trading strategy is a predefined set of rules that dictates when to buy or sell an asset. Gunbot's built-in strategies offer various approaches to automated trading.

Understanding Built-In Trading Strategies

The built-in strategies in this trading bot allow you to cycle through a list of configured trading pairs, collect market data, and place trades according to the rules of the configured trading strategy. Each pair can have its own settings, or variations of settings, offering flexibility for users to adapt to different market conditions.

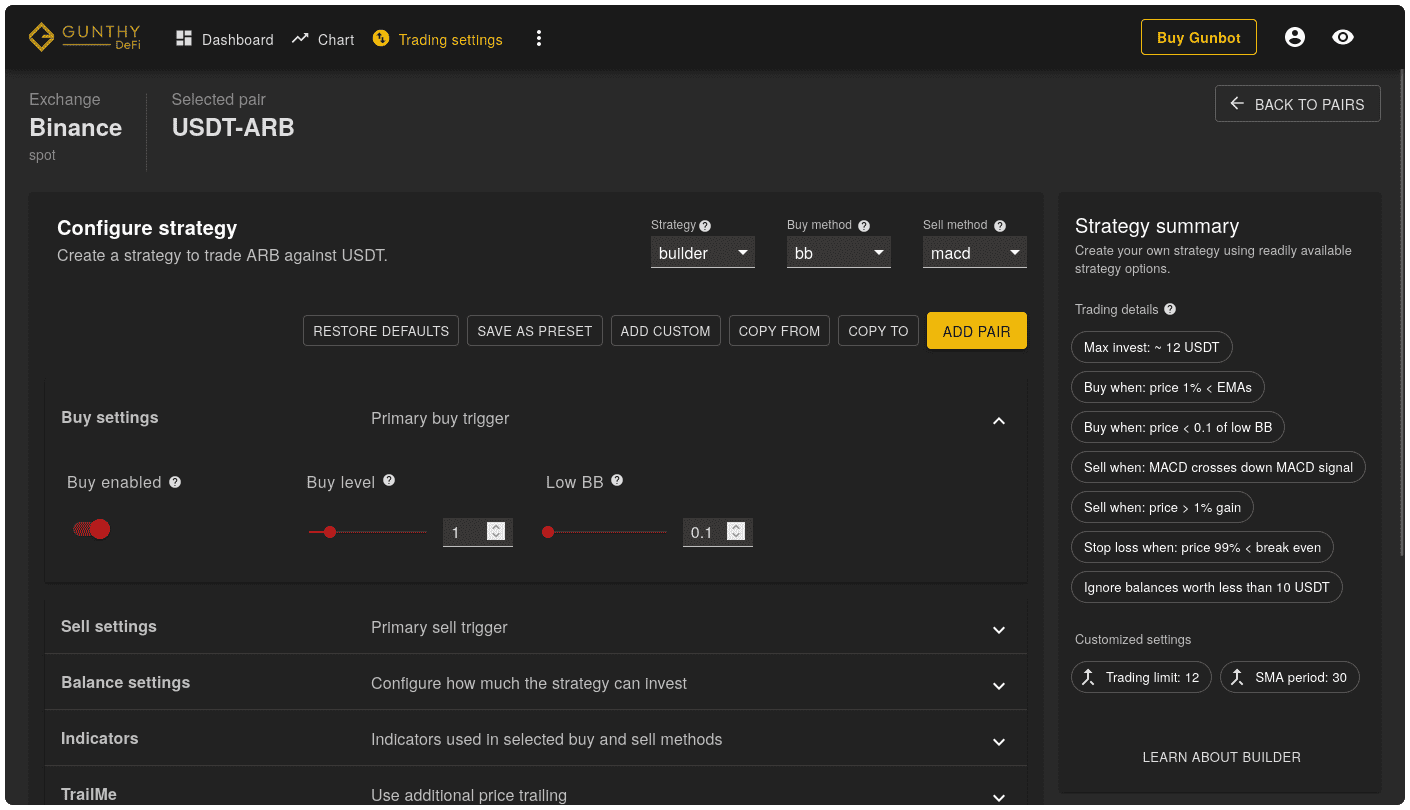

"Built-in" does not mean that the strategies are not configurable—each strategy comes with its own set of parameters to fine-tune performance. For example, with a few clicks, you could create a strategy that buys when the price hits the lower Bollinger Band and sells when a target percentage profit is reached. This level of customization makes Gunbot's built-in strategies both powerful and user-friendly for traders of all levels.

Examples of Built-In Bot Trading Strategies

Gain Strategy: This strategy focuses on buying when prices are low and selling when the market rises to a predefined percentage gain. It's great for traders who prefer simple, rule-based trading that focuses on capitalizing on price fluctuations.

Stepgrid Strategy: This grid-like strategy places buy and sell orders at predefined price intervals. It’s ideal for volatile markets where you can benefit from both upward and downward price movements.

Bollinger Bands Strategy (BB): This strategy is centered around Bollinger Bands, buying when the price touches the lower band and selling when it reaches a higher threshold. It's useful for trend-following and identifying price reversals.

MACD Strategy: The Moving Average Convergence Divergence (MACD) strategy uses the MACD indicator to buy and sell at calculated points based on momentum changes. This is a go-to strategy for traders who want to capture medium-term trends.

Creating Your Own Strategy Rules

For users who prefer to create their own trading rules, Gunbot's strategy builder tool enables a high degree of customization. You can choose from a wide range of indicators—such as RSI, MACD, EMA, and more—and set specific buy/sell rules based on your preferences.

Some common customizations include:

- Indicator-Based Rules: Set buy and sell conditions based on technical indicators like RSI, moving averages, or volume. For example, you might create a rule that buys when the RSI dips below 30 (oversold) and sells when it crosses above 70 (overbought).

- Time-Based Rules: Schedule trades to execute at specific intervals, regardless of indicator values. This is especially useful for time-based strategies like dollar-cost averaging.

- Combination Strategies: Use multiple indicators and conditions to create more sophisticated strategies. For example, you could combine Bollinger Bands with RSI to filter out false signals and only trade when both conditions are favorable.

📄️ Spot strategy builder

The strategy builder for spot markets in Gunbot allows you to create and personalize your trading strategies with a wide range of options. You can choose any two methods as the primary buy and sell triggers, giving you flexibility and control over your trading decisions.

📄️ Futures strategy builder

Learn how to use the futures trading strategy builder to create and customize your trading strategies with a wide range of options and modules.

Strategies with Opinionated Trading Rules

If creating your own strategy seems overwhelming, Gunbot offers strategies with opinionated trading rules that have a smaller set of configurable options. These grid-like strategies are designed to help users get started quickly, offering simplicity while still being effective.

For example:

- Stepgrid: A beginner-friendly strategy that automates grid trading with a few basic settings. It’s particularly popular for spot trading due to its straightforward approach to capitalizing on price fluctuations.

- Stepgridhybrid: An advanced version of Stepgrid that introduces more flexibility and control, such as dynamic adjustments to grid spacing based on market conditions.

- Spotgrid: This strategy focuses on spot trading with optimized grid settings. It works well in markets with frequent ups and downs, enabling you to profit from both upward and downward price movements.

When in doubt, the Stepgrid strategy is always an excellent starting point for spot trading. Once you’re comfortable with it, you can move on to more advanced strategies like Stepgridhybrid or Stepgridscalp, which offer additional features like trailing stop losses, partial sell options, and more.

📄️ Stepgridscalp (popular on spot)

Learn about the StepGridScalp strategy, a sophisticated spot trading approach in Gunbot balancing scalping and grid trading with advanced trend analysis.

📄️ Sgsfutures (popular on futures)

A futures grid strategy that's almost exactly like the spot stepgridscalp strategy. The main difference is that it does not (small stop losses aside) partially close trades at prices worse than avg. entry price. Default settings differ from spot, and ensure a higher trading frequency.

Strategy Best Practices

To get the most out of Gunbot's built-in strategies, consider the following best practices:

- Backtest Your Strategy: Before live trading, backtest your strategy on historical data to evaluate its performance under different market conditions.

- Start Small: Begin with smaller trading limits while you fine-tune your strategy. This minimizes risk while allowing you to see how the strategy performs in real-time.

- Diversify Your Pairs: Trade across a range of pairs to spread risk. Gunbot allows you to set different strategies for each pair, enabling you to adapt to various market conditions simultaneously.

- Monitor Performance: Even with automation, it’s essential to monitor your trading bot’s performance regularly. Adjust settings based on market changes to ensure your strategy remains effective.

- Stay Informed: Keep learning about market trends, technical analysis, and how different strategies work. The more informed you are, the better you can optimize your trading strategies.

By following these practices, you'll maximize the potential of Gunbot's built-in strategies while minimizing risks.