Built-In Strategies

The most common way to use Gunbot is with built-in strategies. This page summarizes what they do, how to customize them, and where to start.

A trading strategy is a predefined set of rules that dictates when to buy or sell an asset. Gunbot's built-in strategies offer various approaches to automated trading.

Understanding Built-In Trading Strategies

Built-in strategies cycle through your configured trading pairs, collect market data, and place trades according to the strategy rules. Each pair can have its own settings, so you can adapt to different market conditions.

"Built-in" does not mean fixed. Each strategy includes parameters you can tune. For example, you can set a strategy to buy when price touches the lower Bollinger Band and sell at a target percentage gain.

Examples of Built-In Bot Trading Strategies

Gain Strategy: Buys when prices are low and sells when the market reaches a predefined percentage gain.

Stepgrid Strategy: Places buy and sell orders at predefined price intervals. It’s suited to volatile markets where you can benefit from both upward and downward moves.

Bollinger Bands Strategy (BB): Buys when the price touches the lower band and sells when it reaches a higher threshold. Useful for trend-following and identifying reversals.

MACD Strategy: The Moving Average Convergence Divergence (MACD) strategy uses the MACD indicator to buy and sell based on momentum changes, which can help capture medium-term trends.

Creating Your Own Strategy Rules

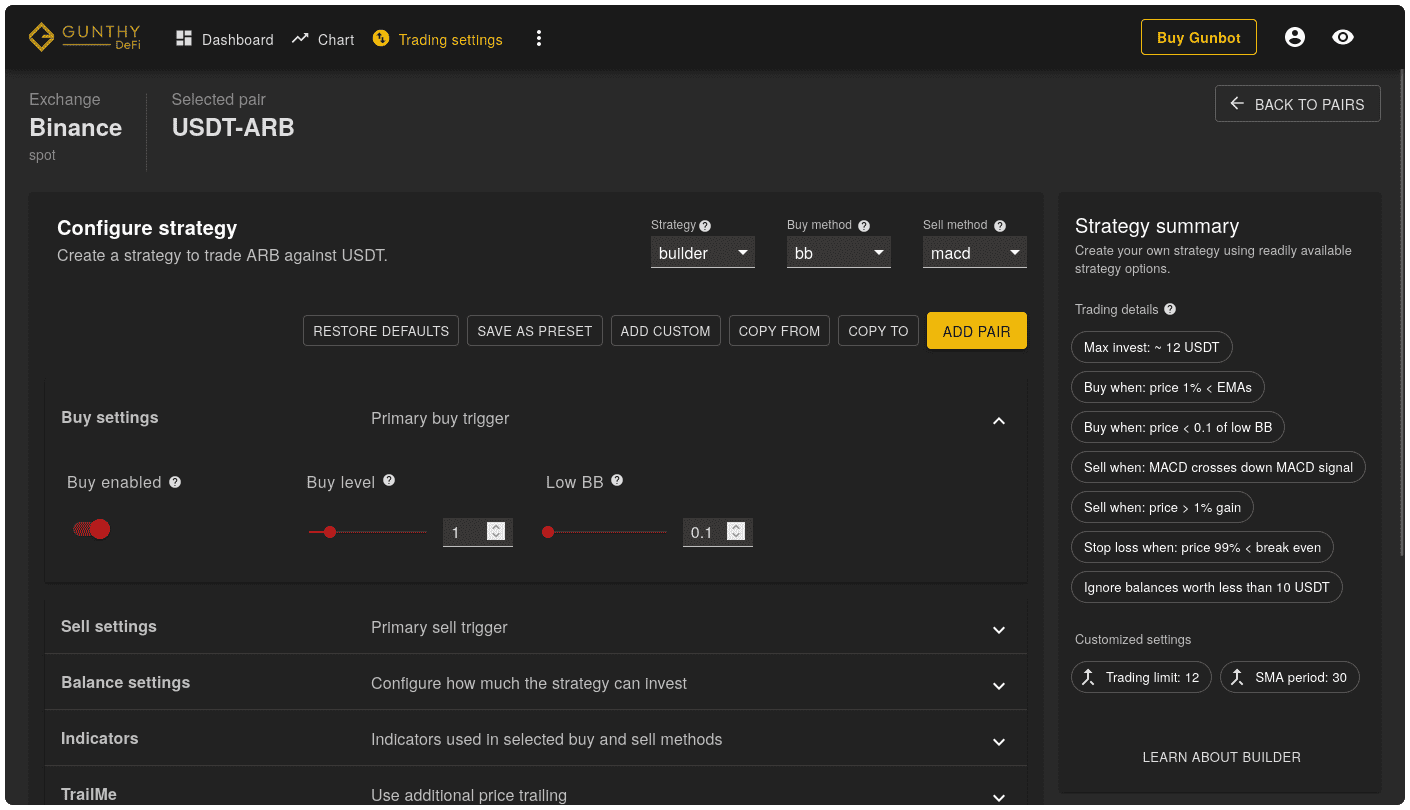

If you prefer to create your own trading rules, Gunbot's strategy builder lets you choose indicators—such as RSI, MACD, EMA—and set specific buy/sell rules.

Some common customizations include:

- Indicator-Based Rules: Set buy and sell conditions based on indicators like RSI, moving averages, or volume. For example, buy when RSI dips below 30 (oversold) and sell when it crosses above 70 (overbought).

- Time-Based Rules: Schedule trades to execute at specific intervals, regardless of indicator values. Useful for time-based strategies like dollar-cost averaging.

- Combination Strategies: Use multiple indicators and conditions to filter signals. For example, combine Bollinger Bands with RSI and trade only when both conditions are met.

📄️ Spot strategy builder

Gunbot’s strategy builder for spot markets lets you create and customize strategies by selecting a primary buy method and a primary sell method. You can also add modules to refine entries, exits, and risk handling. Available module categories include Balance, Indicator, TrailMe, DCA, Confirming Indicators, Reversal Trading, Stop Loss, and Miscellaneous.

📄️ Futures strategy builder

Learn how to use the futures trading strategy builder to create and customize your trading strategies with a wide range of options and modules.

Strategies with Opinionated Trading Rules

If creating your own strategy feels like too much, Gunbot also offers strategies with opinionated trading rules and fewer options. These grid-like strategies are designed for a quick start while still being effective.

For example:

- Stepgrid: A beginner-friendly strategy that automates grid trading with a few basic settings. Popular for spot trading.

- Stepgridhybrid: An advanced version of Stepgrid with more flexibility, including dynamic adjustments to grid spacing.

- Spotgrid: Focuses on spot trading with optimized grid settings. Works well in markets with frequent ups and downs.

When in doubt, Stepgrid is a solid starting point for spot trading. Once you’re comfortable, move on to Stepgridhybrid or Stepgridscalp, which add features like trailing stop losses and partial sells.

📄️ Stepgridscalp (popular on spot)

Learn about the StepGridScalp strategy, a sophisticated spot trading approach in Gunbot balancing scalping and grid trading with advanced trend analysis.

📄️ Sgsfutures (popular on futures)

A futures grid strategy that closely mirrors the spot stepgridscalp strategy. The main difference is that it does not (small stop losses aside) partially close trades at prices worse than the average entry price. Default settings differ from spot and are tuned for higher trading frequency.

Strategy Best Practices

To get the most out of built-in strategies, consider the following best practices:

- Backtest Your Strategy: Before live trading, backtest your strategy on historical data to evaluate performance under different market conditions.

- Start Small: Begin with smaller trading limits while you fine-tune your strategy.

- Diversify Your Pairs: Trade across a range of pairs to spread risk. Gunbot lets you set different strategies per pair.

- Monitor Performance: Review performance regularly and adjust settings based on market changes.

- Stay Informed: Keep learning about market trends, technical analysis, and how different strategies work.

These practices help you maximize performance while managing risk.