ADX

Use the ADX indicator to determine when to buy and sell. This indicator measures the strength of a trend, allowing Gunbot to buy during strong uptrends and sell during strong downtrends. Gunbot uses ADX together with Directional Index.

ADX is a popular technical analysis tool used by traders to identify trends in the market. It is calculated using a series of calculations that take into account the highs and lows of price movements over a specified time period. Generally, an ADX reading above 25 indicates a strong trend, while a reading below 20 suggests a weak trend. The ADX can be used in conjunction with other indicators to confirm trading signals and help traders make informed decisions.

How to work with it

Buy method conditions

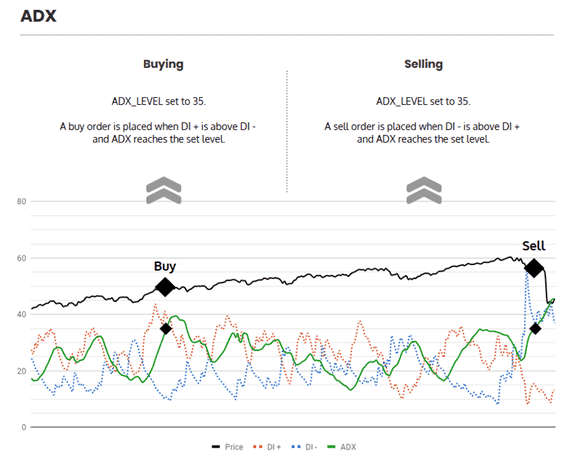

Buy allowed when ADX value exceeds 'ADX level' and DI+ is above DI-.

Sell method conditions

Sell allowed when ADX value exceeds 'ADX level' and DI- is above DI+.

Gain protection is optional for this method.

Be aware that this can lead to sell orders below your break-even point.

Trading example

Example of how trading with this strategy can perform. Details and settings.

The infographic below describes what triggers trades with this strategy.

ADX Strategy settings

Buy settings

| Label | Config Parameter | Default Value | Detailed Description |

|---|---|---|---|

| Buy enabled | BUY_ENABLED | true | Enables the ability for you to place buy or long orders. When enabled, the strategy will initiate purchases according to other defined parameters. |

Sell settings

| Label | Config Parameter | Default Value | Detailed Description |

|---|---|---|---|

| Sell enabled | SELL_ENABLED | true | Allows the strategy to place sell or short orders. |

| Double check gain | DOUBLE_CHECK_GAIN | true | Ensures a positive gain is achieved before allowing a sell order to proceed. Disabling this setting allows for the possibility of selling at a loss based on other indicators' suggestions. |

| Gain | GAIN | 1 | Sets the gain target above break-even, expressed as a percentage. Adjustable range is between 0.1% and 5%, ensuring flexibility in targeting desired profits. |

| Count sell | COUNT_SELL | 9999 | Configures the number of sell orders allowed before disabling the trading pair. This limits the number of sales transactions since adding the pair, offering a control measure on trading frequency. |

Indicators

| Label | Config Parameter | Default Value | Detailed Description |

|---|---|---|---|

| Period | PERIOD | 15 minutes | Specifies the duration of candlesticks used in the calculation of indicators. This should align with supported periods available on your exchange. The value represents the candlestick duration in minutes. |

| ADX level | ADX_LEVEL | 25 | Sets the minimum trend level required to initiate trades, with a configurable range from 1 to 99. This setting helps in identifying the strength of the trend needed to consider entering a trade. |

| DI period | DI_PERIOD | 14 | Defines the number of candlesticks to use for calculating the ADX. Adjustable from 10 to 50, allowing you to tailor the sensitivity of the ADX indicator to the desired timeframe. |

Overview of effects on different order types

| Config Parameter | Affected Order Types | Not Affected Order Types |

|---|---|---|

| Buy Enabled | Strategy buy, DCA buy, RT buy, RT buyback | Strategy sell, Stop limit, Close, RT sell |

| Buy Level | Strategy buy | Strategy sell, Stop limit, Close, RT sell, DCA buy, RT buy, RT buyback |

| Sell Enabled | Strategy sell, Stop limit, RT sell | Strategy buy, RT buy, RT buyback, Close, DCA buy |

| Gain | Strategy sell | Strategy buy, RT buy, RT buyback, RT sell, Close, DCA buy, Stop limit |

| Period | Strategy sell, Strategy buy, DCA buy (when using an indicator to trigger) | RT buy, RT buyback, RT sell, Close, Stop limit |

| ADX Level | Strategy sell, Strategy buy | RT buy, RT buyback, RT sell, Close, Stop limit, DCA buy |

| DI Period | Strategy sell, Strategy buy | RT buy, RT buyback, RT sell, Close, Stop limit, DCA buy |