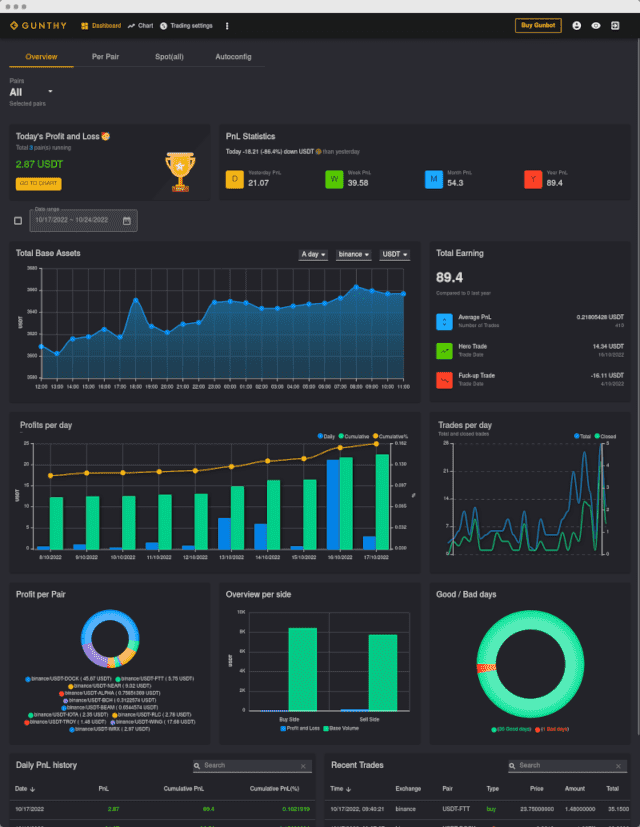

Complete Toolkit for Algorithmic Trading

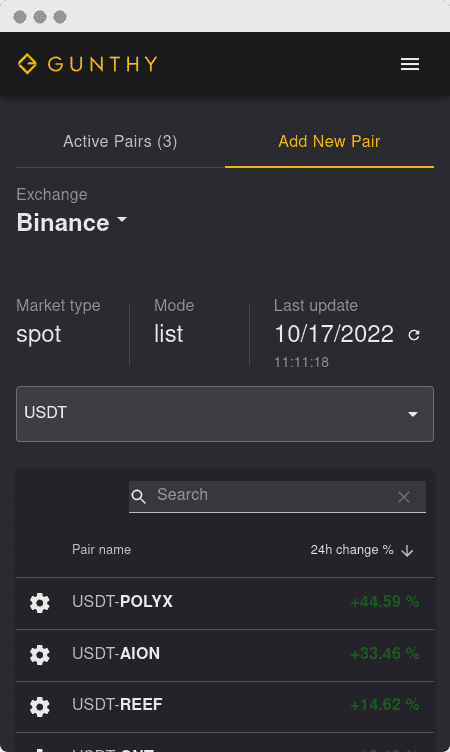

Native Exchange Integrations

Phone Friendly Browser Interface

Spot & Futures Strategy Library

20+ Algorithmic Trading Strategies

Gridbots

Average Directional Index (ADX)

Average True Range (ATR) Trailing Stop

Bollinger Bands

Bollinger Bands - crossover (BBTA)

EMA spread

Emotionless

Gain

Liquidity provider

MACD

MACDH

Pingpong

SpotGrid

FuturesGrid

SpotGridAdvanced

StepGrid

Stepgain

SMA cross

Support / resistance

Tenkan

Time series analysis

Trailing stop / stop limit (TSSL)

Trade Unlimited Pairs Simultaneously

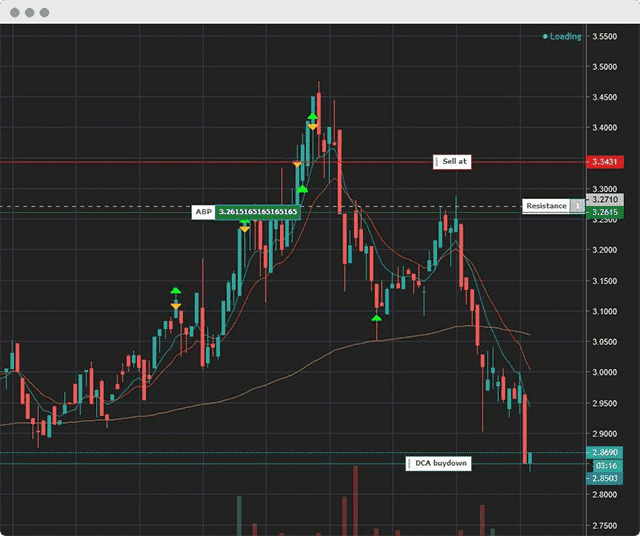

Dollar Cost Averaging (DCA) Engine

Systematically lower your average entry price during market drawdowns. Gunbot's DCA module allows you to average down positions to reach profitable exit points sooner.

Configure advanced averaging logic:

- - Trigger sources: Price percentage drops, RSI oversold levels, Bollinger Band crossovers, or custom script conditions.

- - Dynamic Spacing: Adjust distance between buys based on volatility.

- - Martingale Sizing: Configurable multipliers for subsequent buy orders.

- - Exposure Limits: Hard caps on maximum DCA levels and total investment.

Reversal Trading (Bag Management)

Portfolio & Risk Management

Native Technical Indicators

Construct robust strategies using confirming indicators to validate market conditions before execution.

Example: Only execute long orders when RSI is below 30 and price is above the EMA200.

Native indicators include:

- - ADX (Trend Strength)

- - EMA / SMA (Moving Averages)

- - EMA Spread

- - Ichimoku Cloud

- - MFI (Money Flow Index)

- - RSI (Relative Strength)

- - Stochastic & StochRSI

- - Bollinger Bands

- Access hundreds more via the integrated Tulip indicator library.

Intelligent Price Trailing

Maximize entry and exit efficiency by trailing price action rather than using static limit orders.

Example: Instead of buying immediately when a Bollinger Band is hit, the bot waits for the price to bottom out and start reversing (the "wick"), ensuring a better entry price.

Trailing is available for:

Types of orders that allow additional trailing:

- - Standard Entries & Exits

- - DCA (Averaging) Orders

- - Reversal Trading Cycles

- - Futures Position Closing

- - Stop-Loss Triggers

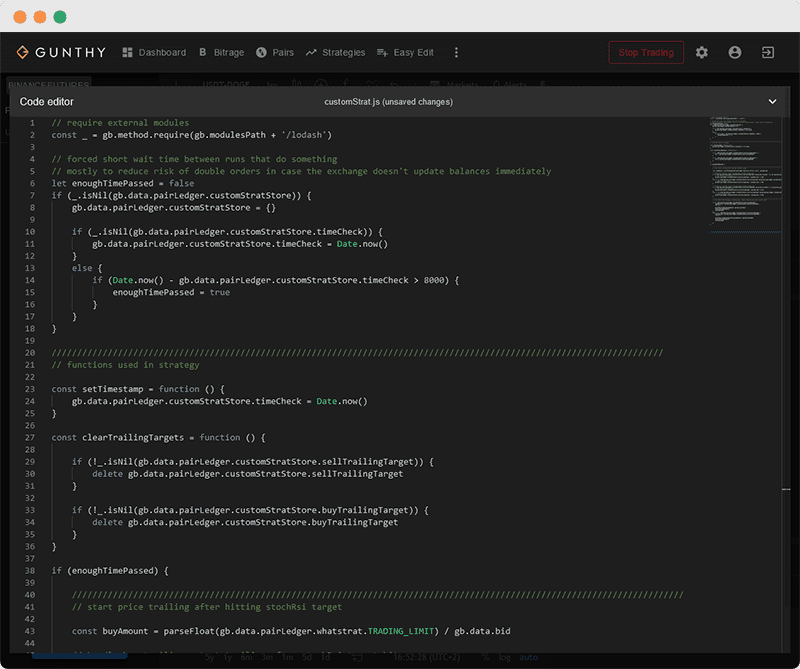

Code your own trading edge

Focus on the logic, not the connectivity. Simply define your trade conditions in JavaScript, and Gunbot handles the API connections, WebSocket data feeds, and order execution. Use our AI tools to rapidly prototype valid code.

Create unlimited custom strategies, import external NPM modules for advanced math, and execute across any number of pairs..

Developer documentation

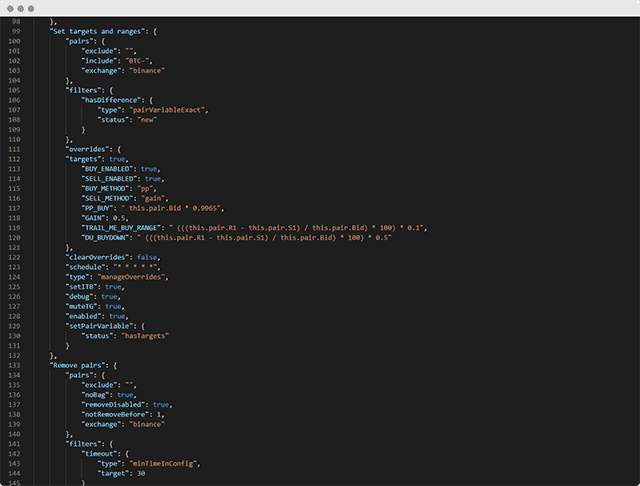

AutoConfig

AutoConfig allows you to dynamically alter the bot's behavior based on market events. Automatically cycle pairs, adding only the top 10 by volume, or filter out assets with low volatility.

Chain complex jobs: monitor an indicator on Pair A to trigger a configuration change on Pair B. Adjust risk settings, switch strategies, or halt trading based on global market health.

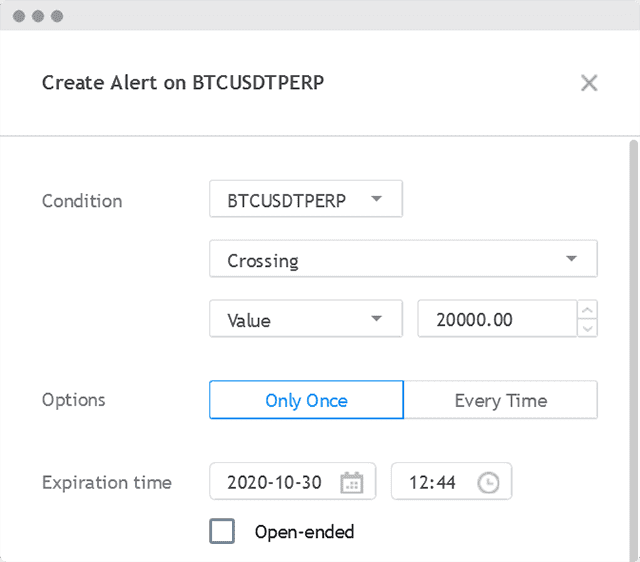

TradingView Webhook Listener

Execute alerts sent directly from TradingView via webhooks (Pine Script). This allows you to keep your strategy logic on the chart while Gunbot handles the API execution.

Includes safety layers like minimum volume checks and break-even validation. You can run in "Mixed Mode," combining Gunbot's internal logic with external signal triggers.

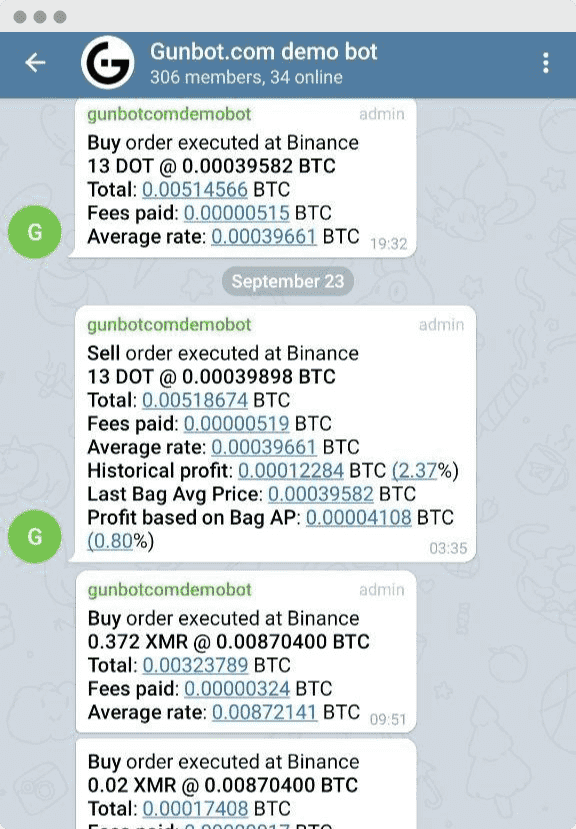

Telegram Integration

PnL Reporting

Live Configuration

Trade Alerts

Status Monitor

Windows, macOS, Linux, Raspberry Pi

Gunbot is software you own. Install it on your local machine, a VPS, or a dedicated server. Updates are included for life.

Minimum system requirements:

- - 2GB RAM

- - 10GB disk space

- - 64-bit CPU

Operate via the visual GUI or run lightweight in headless mode via command-line.