Get started with dYdX and Gunbot with our easy-to-follow guide. We'll introduce you to API trading on a decentralized exchange using automated trading software. By the end of it, you'll feel confident to venture into dYdX trading using Gunbot.

Explore how to capitalize on the dYdX exchange's Decentralized Layer 2 Perpetuals using Gunbot for trading automation.

About dYdX and Its Unique Layer 2 Perpetuals

dYdX is a decentralized exchange (DEX) that has rapidly risen to prominence due to its innovative approach to crypto trading. The dYdX exchange stands out in the DeFi space with its unique Decentralized Layer 2 (L2) Perpetuals, which offer extremely low trading fees. While it operates like a Centralized Limit Order Book exchange, it maintains the benefits of decentralization, making it ideal for crypto bot trading.

These DeFi L2 Perpetuals use a 'roll-over' system, keeping positions open indefinitely until the trader decides to close them. They offer efficient tools for diverse trading strategies, whether long-term or short-term. Trading on dYdX allows you to retain control over your positions and funds, even when the exchange faces issues.

Overcoming Unforeseen Events: Forced Withdrawals & Position Closure

dYdX ensures that traders can preemptively exit their positions and access their funds, even if the exchange is offline or unavailable. Here's how it works:

Forced Withdrawals: If the exchange encounters issues or becomes inaccessible, traders can rely on the smart contract-powered architecture of dYdX to perform seamless forced withdrawals. This ensures that traders can retrieve their funds and maintain control over their assets.

Forced Closing of Positions: dYdX also allows for the forced closing of positions on L2, enabling traders to proactively close open positions before executing a withdrawal.

With these functionalities in mind, let's explore how Gunbot can enhance your trading experience on dYdX.

Using Gunbot with dYdX exchange

Gunbot, a leading automated trading software that runs from your own device, supports trading Perpetual Futures on dYdX. This feature provides an alternative to trading on centralized futures exchanges. Here's how to get started:

Getting Your API Credentials for bot trading

- Begin by connecting your wallet to dYdX. This process is the web3 equivalent of 'creating an account' on centralized exchanges.

- During this process, ensure you select the 'remember me' option.

- No need to create an API key; it's automatically generated for you.

- Store your API Key and Secret securely as they're essential for Gunbot setup.

🔒 Security Tip: Guard your API secrets rigorously, never share them. Gunbot only stores API secrets on your local device.

The steps are simplified here, refer to our full guide on retrieving the dYdX api credentials for more details.

Setting up Gunbot Using the sgsfutures Strategy

With your API credentials ready, you can set up your preferred trading strategy. Here’s how to implement the sgsfutures strategy:

- Access your Gunbot user interface.

- Go to 'Trading Settings' and add a new trading pair for the DeFi market you wish to trade. Use the correct pair name format, such as USD-ETH.

- Choose

sgsfuturesas the strategy. - In the Balance settings category, adjust the following:

Trading limit(amount in USD)Max open contracts(amount in ETH)Max loss(amount in USD) These settings define the default amount per buy order, maximum position size, and the trigger for stop loss, respectively.

- Fine-tune the rest of the strategy parameters according to your trading preferences. To start with an unrestricted grid, disable the restrictive options listed here.

- Save your settings and start trading.

✅ Congratulations! You've successfully implemented the sgsfutures strategy for automated trading on the dYdX Exchange.

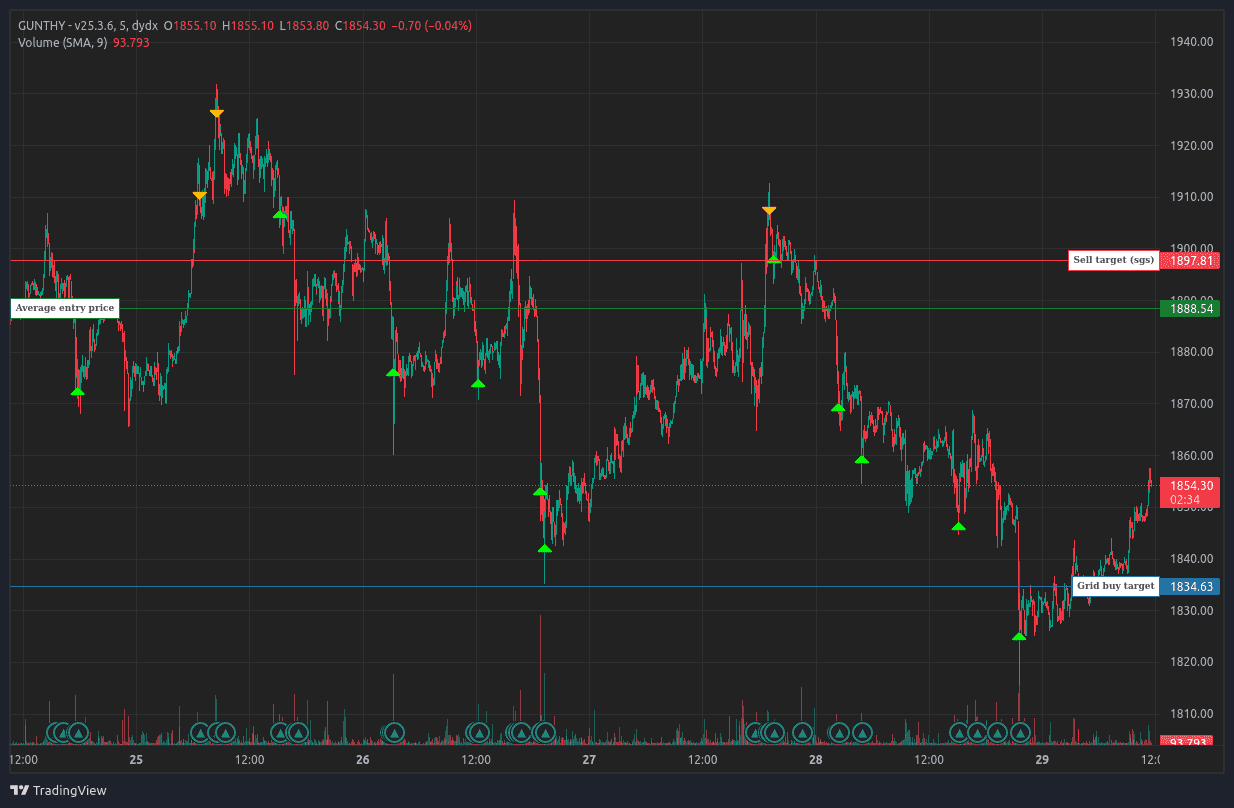

Typical sgsfutures Trading Behavior

Info:

sgsfuturesis a versatile strategy that adapts to market phases. It monitors trends, momentum, and more across multiple timeframes, alternating between various trading styles like grid trading, scalping, and support trading.

In Conclusion

Revolutionize your crypto trading experience on the dYdX exchange with Gunbot. This powerful crypto trading bot offers cutting-edge features and a supportive community to help you excel in the crypto market. By combining Gunbot’s automation capabilities with dYdX’s innovative platform, you can maximize your returns and manage your risks effectively. Remember, continuous learning and strategic adaptability are key to staying ahead. 🚀

With this guide, you are now equipped to start trading on dYdX using Gunbot. Enjoy the benefits of automated trading and take control of your crypto investments today!