PingPong (Futures)

This fixed-price strategy is ideal for trading pairs that fluctuate within a predictable price range for extended periods. Simply set buy and sell prices, and Gunbot will execute trades as soon as the target price is met or exceeded.

A fixed-price strategy involves setting predetermined price levels for buying and selling an asset. This approach is often used in markets that exhibit range-bound behavior.

To enhance this approach, Gunbot offers additional indicators for both buying and selling confirmation. For instance, you can configure Gunbot to purchase at a specified price only when the RSI (Relative Strength Index) is 30 or lower.

How to Work With It

Gunbot will open one position, either long or short, and close this position when the target is reached. When the stop is hit before profitably closing a trade, Gunbot will place a stop order at loss. After closing a position, Gunbot will again look to open a new long or short position. Gunbot will not add to existing open positions.

Please don't manually add to or reduce positions opened by Gunbot, unless you stop running Gunbot on this trading pair until you've closed this position.

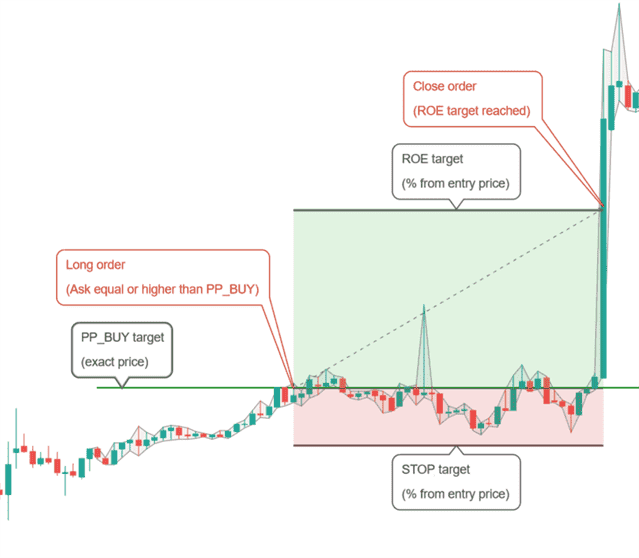

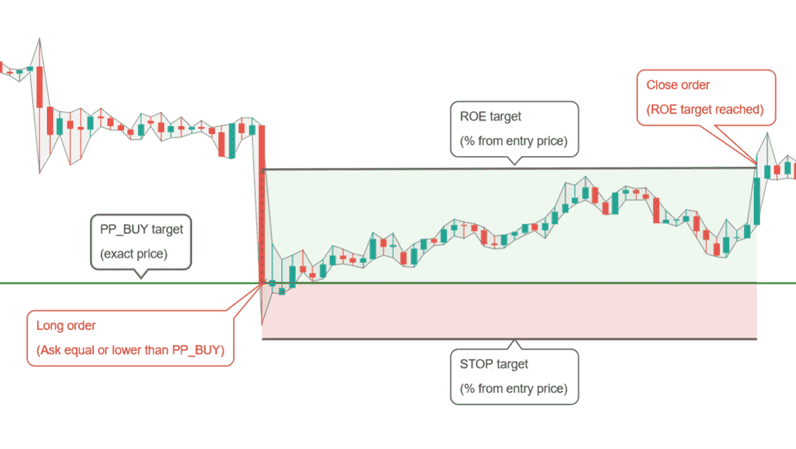

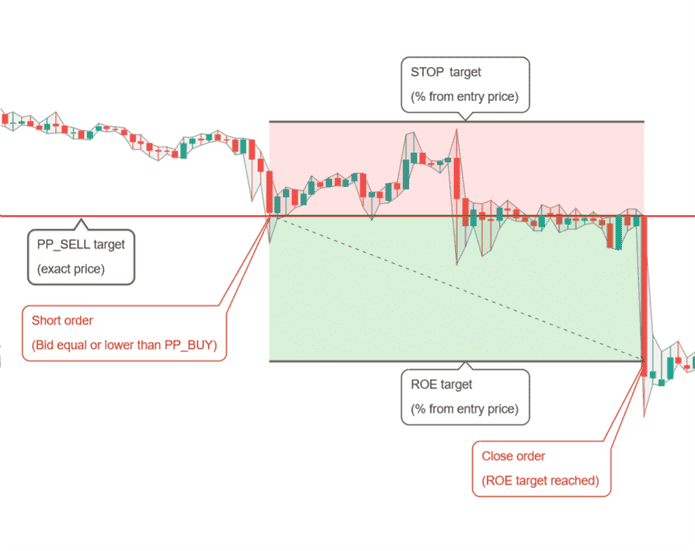

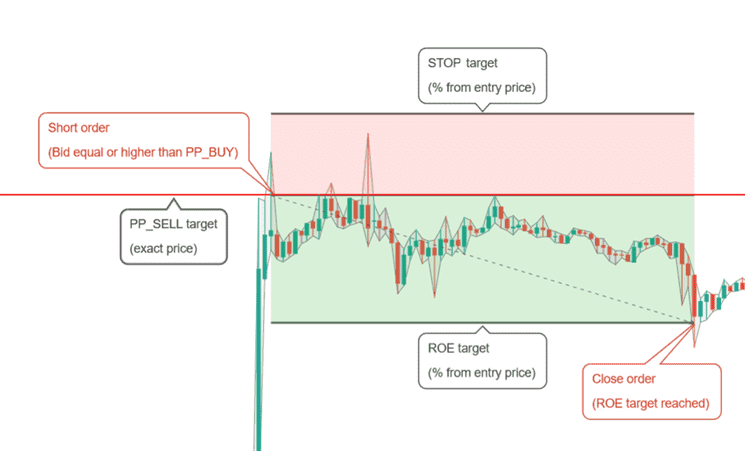

The examples below show how the basic triggers for pp work. Additionally, you can use confirming indicators and settings like ROE trailing.

Buy Method Conditions

Trend Following (Regular)

Opening a long position is allowed when the ask price is equal to or above PP_BUY.

Mean Reversion

In MEAN_REVERSION mode, the behavior for PP_BUY and PP_SELL is reversed in this strategy.

Opening a long position is allowed when the ask price is equal to or below PP_BUY.

Sell Method Conditions

Trend Following (Regular)

Opening a short position is allowed when the bid price is equal to or below PP_SELL.

Mean Reversion

In MEAN_REVERSION mode, the behavior for PP_BUY and PP_SELL is reversed in this strategy.

Opening a short position is allowed when the bid price is equal to or above PP_SELL.

Conditions to Close

A position is closed when the desired ROE (Return on Equity) is reached.

Conditions to Stop

A position is closed at loss when its stop is reached.

Strategy Settings for PingPong (Futures)

Long Settings

| Label | Config Parameter | Default Value | Detailed Description |

|---|---|---|---|

| Buy Enabled | BUY_ENABLED | true | Allows you to enable or disable the ability to place buy or long orders in your trading strategy. |

| PingPong Buy | PP_BUY | 1000 | Specifies the exact price target to initiate a buy order using the PingPong method. Setting this parameter allows precise control over the price at which you wish to enter the market. |

Short Settings

| Label | Config Parameter | Default Value | Detailed Description |

|---|---|---|---|

| Sell Enabled | SELL_ENABLED | true | Allows you to enable or disable the ability to place sell or short orders in your trading strategy. |

| PingPong Sell | PP_SELL | 1000 | Defines the exact price target for executing a sell order using the PingPong method. This parameter ensures you can set a specific price at which you aim to exit the market, thereby locking in potential profits or limiting losses. |

Indicators

| Label | Config Parameter | Default Value | Detailed Description |

|---|---|---|---|

| Period | PERIOD | 15 | The period parameter specifies the duration of candlesticks in minutes used for calculating indicators. The default setting is 15 minutes. It is crucial to choose a period that is supported by your exchange to ensure the accuracy of the indicators used in your strategy. |

| Mean Reversion | MEAN_REVERSION | false | Enables or disables the mean reversion variant within your buy and sell strategies. When set to false, as it is by default, the strategy does not use mean reversion techniques. Enabling this setting adjusts the strategy to potentially capitalize on the return of a stock’s price to its mean or average. |